Many individuals frequently ponder, "When can I retire social security?" This essential guide offers a clear, empowering pathway to understanding the intricacies of retirement benefits. It meticulously explores the various age requirements, stringent eligibility criteria, and crucially, how your decision to claim benefits will profoundly impact your eventual monthly income. Discover the subtle yet significant differences between taking early retirement, claiming at your full retirement age, and leveraging delayed retirement credits, providing you with the clarity needed to pinpoint your ideal start date for receiving your well-deserved benefits. We carefully dissect the multitude of factors that influence your benefit amount, including your lifetime earnings record and the precise age you opt to apply. Navigating the Social Security system can often feel like a formidable challenge, but this article demystifies the entire process, furnishing you with actionable, easy-to-implement insights for confidently shaping your financial future. Whether your retirement is still years away or you're on the verge of making a pivotal decision, this comprehensive information equips you with the knowledge to make truly informed and strategic choices. Mastering your Social Security options is absolutely indispensable for securing a comfortable, stress-free retirement. Learn effective strategies to maximize your benefits and ensure a consistent, reliable income stream for your cherished golden years. This guide is crafted to address all your pressing questions about when you can retire and what to anticipate from your Social Security benefits.

When exactly can I retire and start receiving my Social Security benefits? Many of us ask this exact question as we look toward our golden years, pondering who is eligible, what the different claiming ages mean, when is the best time to apply, where to find personal benefit information, why careful planning truly matters, and how these decisions shape our financial future. The journey to understanding "when I can retire Social Security" involves navigating various rules and age requirements set by the Social Security Administration. This comprehensive guide serves as your trusted companion, offering clear, empowering insights to help you confidently determine your optimal Social Security claiming strategy. We're going to break down the complexities, turning what might seem like a daunting task into an achievable plan, ensuring you make the most informed choices for a secure and joyful retirement. We'll explore the critical ages, explain eligibility, and reveal how each decision you make can significantly impact the size of your monthly Social Security check, guiding you toward a more financially stable tomorrow.

When Can I Retire Social Security? Understanding Your Options

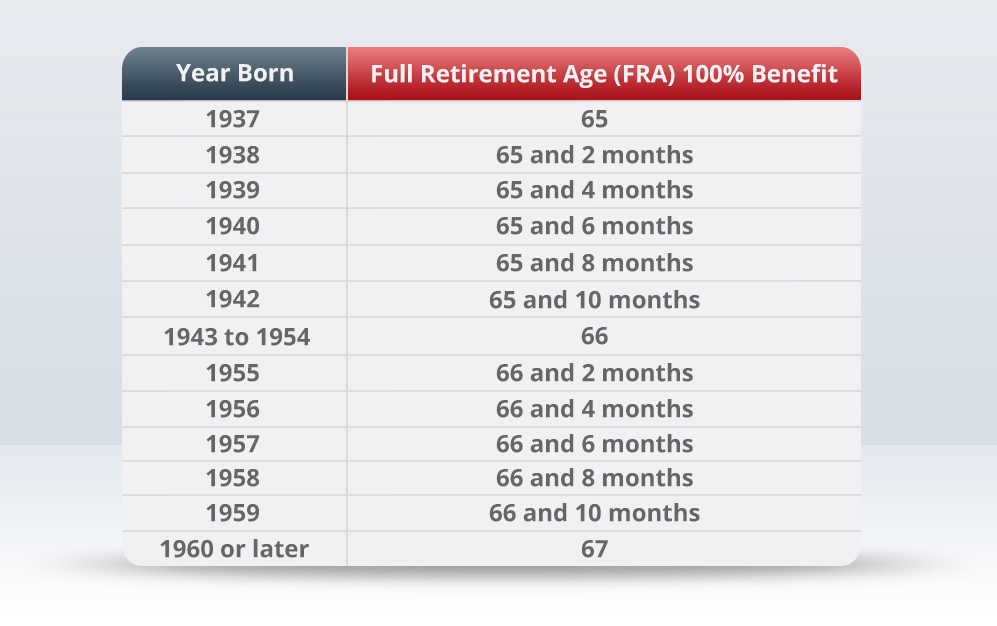

Thinking about when you can retire and begin collecting Social Security benefits is a big step, and it's totally normal to feel a mix of excitement and maybe a little confusion. What is the deal with Full Retirement Age (FRA), and why does it matter so much? Your Full Retirement Age isn't a one-size-fits-all number; it actually depends on your birth year. For most people currently planning their retirement, this age falls between 66 and 67. Reaching your FRA is a significant milestone because it's the point where you qualify to receive 100 percent of the monthly benefit amount you've earned based on your lifetime earnings. Understanding this specific age is the cornerstone of any effective Social Security claiming strategy. It helps you visualize the potential income you can expect, allowing you to build a more solid financial picture for your future. Don't worry, we'll dive into the specifics, helping you pinpoint your personal FRA with ease so you can move forward with confidence in your retirement planning journey.

Have you ever wondered when you can retire Social Security benefits early, or if that is even a good idea for you? You might be surprised to learn that you can start receiving Social Security benefits as early as age 62. This early claiming option offers flexibility, but it comes with a catch: your monthly benefit amount will be permanently reduced. The reduction occurs because you will receive benefits for a longer period of time. For example, if your Full Retirement Age is 67, claiming at 62 means your monthly check could be reduced by up to 30%. While an earlier start might seem appealing, especially if you need the income or want to enjoy retirement sooner, it’s crucial to weigh this reduction against your long-term financial needs. Many folks find themselves considering this path, so knowing the exact impact on your payments helps you decide if it aligns with your overall retirement goals. It’s all about finding the balance that feels right for your unique situation and ensuring your financial comfort for years to come.

Did you know there’s a way to significantly boost your monthly Social Security payments simply by waiting? This is where delayed retirement credits truly shine, offering a powerful incentive for those who can afford to postpone claiming their Social Security benefits beyond their Full Retirement Age (FRA). For each year you delay claiming past your FRA, up until age 70, your monthly benefit amount increases by a certain percentage, typically around 8% per year. This means if your FRA is 67 and you wait until 70, you could be looking at a substantial increase of about 24% in your monthly check, for life! It's like a guaranteed return on investment, which is pretty sweet when you think about it. Understanding how these credits work and considering if this strategy fits into your retirement plan is key. It's a way to empower yourself with potentially much larger payments, providing an even stronger financial foundation for your later years. Many people find this option incredibly attractive, so let's explore if delaying your claim could be your secret weapon for a more prosperous retirement.

Who is Eligible for Social Security Retirement Benefits? When Can I Retire Social Security

You're probably asking yourself, "Who exactly is eligible to receive Social Security retirement benefits?" Well, the system works by tracking your earnings throughout your working life, and to qualify for benefits, you need to earn enough "work credits." Think of these credits like points you accumulate each year. In 2024, you earn one credit for every $1,730 in earnings, and you can earn a maximum of four credits per year. To become fully insured and eligible for retirement benefits, you generally need to accumulate 40 work credits, which usually translates to about 10 years of working. This doesn't mean you have to work for 10 consecutive years; those credits can be earned over any period. It’s a pretty straightforward system designed to ensure that everyone who contributes through their employment can eventually benefit. Knowing how these work credits function empowers you to track your progress and ensure you’re on the right path to eligibility. It’s all about building that foundation for your future financial security, one credit at a time.

Beyond your own work history, are you aware that Social Security benefits can extend to your spouse? This often-overlooked aspect of the system provides crucial support, particularly if one spouse has little or no work history, or a lower earnings record. A spouse may be eligible for benefits based on their husband's or wife's work record, even if they have never directly contributed to Social Security themselves. To qualify, your spouse must generally be at least 62 years old, or caring for your child who is under age 16 or disabled. The spousal benefit can be up to 50% of the primary earner's Full Retirement Age benefit. This provision highlights the supportive nature of Social Security, ensuring that families have a safety net. Understanding spousal benefits is a vital component of holistic retirement planning, allowing couples to strategize together for the best possible financial outcome. It’s a real game-changer for many families, offering an additional layer of financial protection and peace of mind during retirement.

How Does Your Age Affect Your Social Security Payments? When Can I Retire Social Security

When considering "when I can retire Social Security," one of the most significant factors influencing your monthly check is the age at which you decide to start claiming. It's truly a sliding scale, and understanding this impact is essential for making a confident decision. If you choose to claim benefits early, starting at age 62, your payment amount will be reduced permanently. This reduction can be quite substantial, potentially cutting your full benefit by as much as 30% if your Full Retirement Age is 67. On the flip side, waiting until your Full Retirement Age (FRA) means you receive 100% of your calculated benefit. But here's where it gets even more interesting: if you can delay claiming past your FRA, up until age 70, you earn delayed retirement credits. These credits boost your monthly payment by about 8% for each year you wait. This means that someone with an FRA of 67 who waits until 70 could see their monthly check grow by 24% or more! This difference over a lifetime can add up to tens of thousands of dollars, making your claiming age a powerful lever in your financial planning for retirement.

The choice between early, full, or delayed claiming truly shapes your retirement income stream and is a key part of answering "when I can retire Social Security." Imagine you have two friends: one claims at 62, the other at 70, both with the same full retirement age benefit. The friend who claimed early will get smaller checks for a longer period, while the friend who delayed will receive much larger checks, though for a shorter duration, assuming similar life expectancies. There's no single "right" answer; what's best for you depends on your personal health, other retirement savings, current income needs, and even your family's financial situation. For instance, if you're in excellent health and have other income sources, delaying could be a smart move to secure a higher lifetime payout. Conversely, if health challenges arise or immediate funds are necessary, early claiming might be the most practical choice. It’s about tailoring the decision to your unique life circumstances, always keeping your long-term financial comfort at the forefront of your thinking. Understanding these impacts empowers you to craft a strategy that truly serves your individual needs.

| Birth Year | Full Retirement Age (FRA) - When Can I Retire Social Security |

|---|---|

| 1943-1954 | 66 |

| 1955 | 66 and 2 months |

| 1956 | 66 and 4 months |

| 1957 | 66 and 6 months |

| 1958 | 66 and 8 months |

| 1959 | 66 and 10 months |

| 1960 and later | 67 |

Why Should You Plan Your Social Security Claiming Strategy? When Can I Retire Social Security

Why bother putting so much thought into "when I can retire Social Security" and developing a claiming strategy? The simple truth is, your Social Security benefits could represent a significant portion of your retirement income, perhaps even the foundation upon which your financial security rests. A well-thought-out plan isn't just about getting money; it's about optimizing those payments to ensure you have enough resources to live comfortably and confidently throughout your golden years. Without a strategy, you risk leaving money on the table, potentially hundreds or even thousands of dollars each month, which could have a profound impact on your quality of life. Think about it: that extra income could fund hobbies, cover unexpected medical expenses, or simply provide a greater sense of peace. Planning helps you maximize your lifetime benefits, considering not just your own needs but also those of your spouse and dependents. It's about taking control of your financial destiny, making informed decisions today that will pay dividends for decades to come, ensuring a more secure and worry-free retirement. This proactive approach turns uncertainty into assurance, giving you the power to shape the retirement you’ve always dreamed of.

Maximizing your lifetime benefits is genuinely about empowering your future self, and it's a critical reason for carefully planning "when I can retire Social Security." While claiming early might provide immediate cash flow, it often means sacrificing a higher monthly payment for the rest of your life. Conversely, delaying your claim, if financially feasible, can lead to substantially larger checks that continue for as long as you live. This isn't just about bigger numbers; it’s about providing a robust income stream that helps combat inflation and provides a stronger financial cushion against unforeseen circumstances. Consider how these decisions impact not only your individual benefits but also potential survivor benefits for your spouse. A higher benefit for you often translates to a higher benefit for your surviving spouse, offering enduring protection. By strategically timing your claim, you are not just thinking about today; you are building a legacy of financial resilience for yourself and your loved ones, making sure every dollar you've earned works as hard as possible for your long-term well-being and security. It's about being smart with your money and investing in your own peace of mind.

Where Can You Find Your Personal Social Security Information? When Can I Retire Social Security

When you're ready to get down to the nitty-gritty and truly understand "when I can retire Social Security" based on your specific earnings history, the very best place to start is directly with the source: the Social Security Administration (SSA). Their official website, SSA.gov, is an absolute treasure trove of information and personalized tools. This isn't just a generic site; it’s where you can create your own "My Social Security" online account, which is like having your personal Social Security concierge. Through this secure portal, you can access your detailed earnings record, check your estimated future benefits at different claiming ages, and review your latest Social Security Statement. It's incredibly empowering to see these numbers laid out clearly, allowing you to visualize how your decisions might impact your actual retirement income. Don't wait until the last minute; setting up this account early provides valuable insights and helps you track your progress toward those crucial 40 work credits, ensuring you’re always in the know about your eligibility and potential benefits. It’s an invaluable resource that puts all the power in your hands, making your retirement planning journey much clearer.

Accessing your "My Social Security" account really is a game-changer when you're exploring "when I can retire Social Security." It’s designed to be user-friendly, putting critical information right at your fingertips. Imagine being able to model different claiming scenarios and see how your estimated monthly benefits change if you claim at 62, at your Full Retirement Age, or at 70. This interactive tool helps you visualize the financial impact of each choice, turning abstract concepts into concrete numbers you can work with. Beyond just benefit estimates, your account also shows your complete earnings history, allowing you to verify its accuracy—a small but important step that can prevent future headaches. You can also manage your direct deposit information, request a replacement Social Security card, and even get instant proof of income. This online platform is not just convenient; it's a powerful tool that empowers you to take an active role in planning your retirement, ensuring you have all the necessary information to make the best decisions for your unique situation. It truly simplifies the often-complex world of Social Security, making it more accessible for everyone.

In wrapping up our chat about "when I can retire Social Security," remember these key points:

- Your Full Retirement Age (FRA) is crucial; it depends on your birth year and determines your full benefit amount.

- You can claim Social Security benefits as early as age 62, but this results in a permanent reduction of your monthly payments.

- Delaying your claim past your FRA, up to age 70, significantly increases your monthly benefit through delayed retirement credits.

- Eligibility requires 40 work credits earned over your working life, ensuring you've contributed to the system.

- Spousal benefits provide a safety net for those with limited work history, potentially offering up to 50% of the primary earner's benefit.

- Strategic planning of your claiming age can greatly impact your lifetime benefits and overall financial security in retirement.

- Utilize your "My Social Security" online account at SSA.gov to access personalized benefit estimates and earnings records.

- Making an informed decision about when to retire Social Security empowers you to secure a more comfortable and confident future.

Social Security retirement age, full retirement age, early retirement Social Security, delayed retirement credits, Social Security benefits, when to claim Social Security, retirement planning, Social Security eligibility, maximize Social Security, retirement income, SSA.gov, My Social Security account, work credits.

Understanding your Full Retirement Age (FRA) is crucial for maximizing Social Security benefits. Claiming benefits early reduces your monthly payment, while delaying can increase it significantly. Eligibility generally requires 40 work credits, accumulated over roughly 10 years of work. Various factors like earnings history, marital status, and spousal benefits influence your total benefit amount. Careful, strategic planning can help you make the best decision for your financial well-being and long-term security. Utilize your 'My Social Security' account for personalized estimates and information.

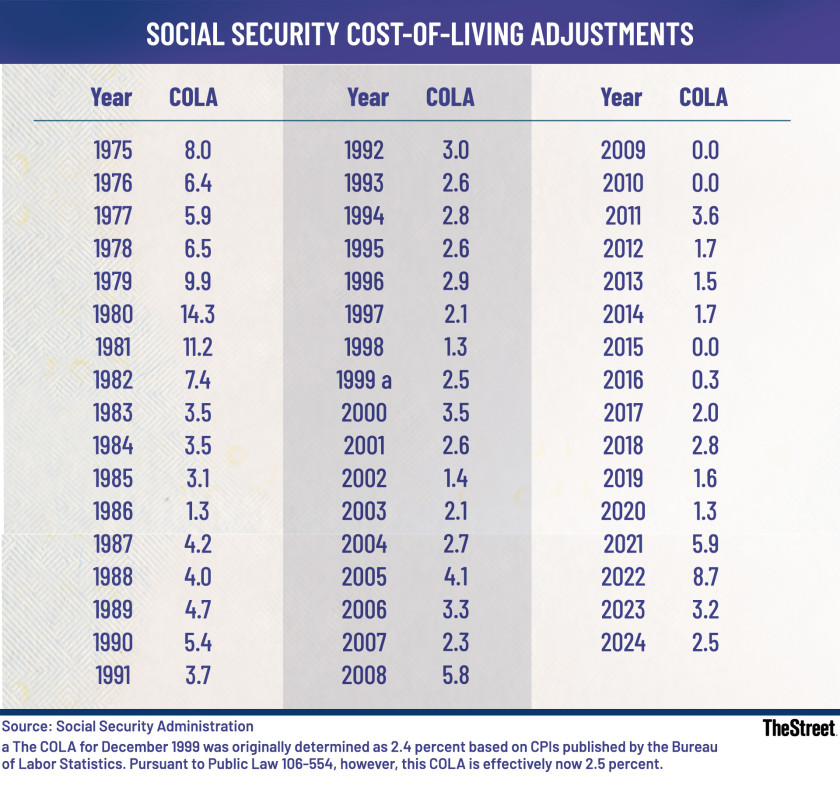

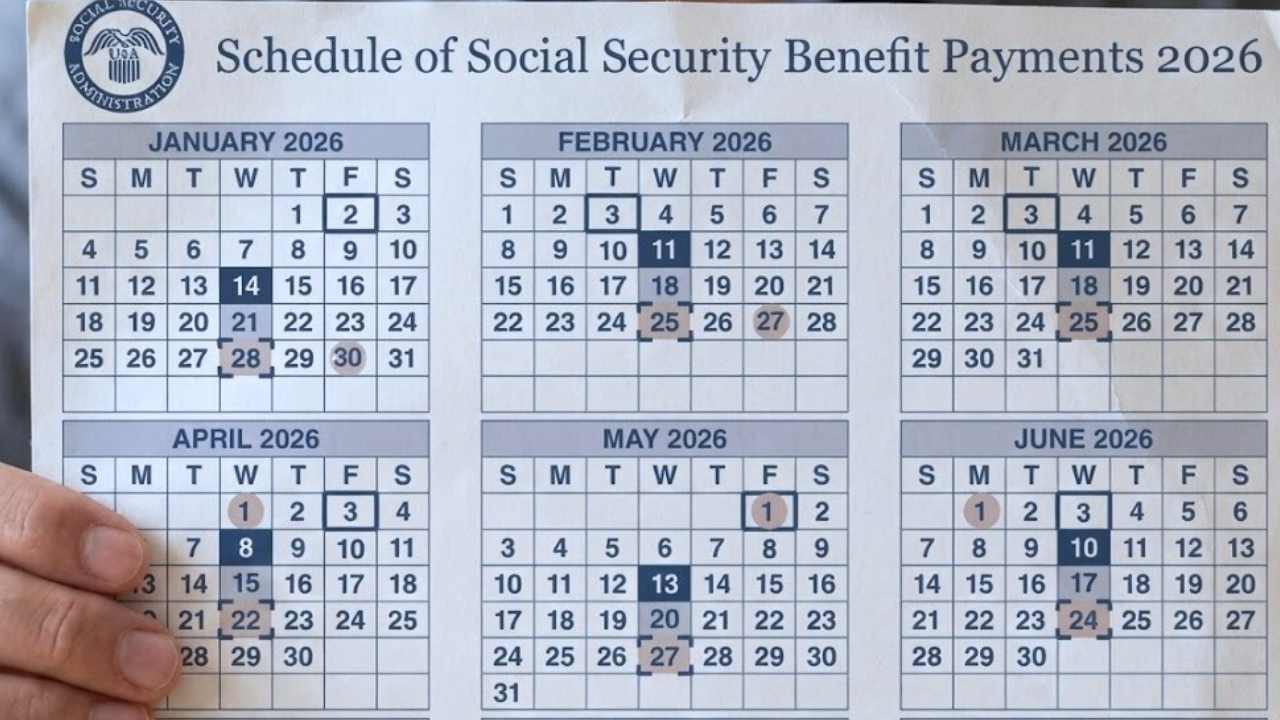

Social Security COLA For 2026 What Retirees Can Expect To EarnNew Retirement Age For Social Security 2026 YouTube Social Security Shares The Complete Payment Schedule For 2026

Social Security 2026 6 New Rules Changing Your Checks Social Security Will Change In 2026.webpSocial Security 2026 New Income Limits And Work Rules For Retirees Social Security 2026 New Income Limits And Work Rules For Retirees 1024x576 Social Security Cost Of Living Adjustment Projected To Be Lower In 2026 108045906 De6Ec Social Security Cost Of Living Adjustments Social Security 2025 Summary Key Policy And Benefit Changes Announced Retirement Planning 2026.webp

SSI Payment Increase For 2026 What Is The New COLA Prediction And New Social Security Retirement Age 2026 Everything Retirees Need To Know Expected Cola For Social Security In 2026 Say Goodbye To Retiring At 65 Social Security Raises Retirement Age In Social Security Raises Retirement Age In 2026 Top Senior Guide To Social Security 2026 COLA Update Tips Social Security 2026 COLA Update Official Guide

Retirement At 65 Is Over Social Security Raises Full Retirement Age Social Security Raises Full Retirement Age For 2026 April Social Security Raise In 2026 Deciding When To Claim Social Security Here S Why Age 62 Might Make SenseSocial Security S New Rules In 2026 What Retirees Need To Know About Social Securitys New Rules In 2026 What Retirees Need To Know.webp

Social Security Retirement Age Increase Begins In 2026 What You NeedSocial Security S Full Retirement Age Is Changing What You Need To Social Security 2026 FRA Changes 2 Signs You Shouldn T Claim Social Security In 2026 Retirely Social Security Cards 4 Gettyimages 154114379 2 Social Security Full Retirement Age Compass Benefits Solutions LLC Social Security Full Retirement Age Cbs 1 820x1024

Social Security The 2026 Payment Schedule For Retirement SSDI And SSI Social Security Payment Schedule For 2026 1024x576 Post Office New Scheme 2025 Senior Citizens Can Earn 20 000 Monthly Social Security Important Update What The 2026 COLA Means For Your Retirement And Medicare Budget.webpHow Does Early Retirement Affect Social Security Benefits Joyc Social Security COLA 2026 Update Estimated 2 5 Increase For Retirees Can Illinois Police Search My Phone During A Traffic Stop Heres What The Law Says 2025 08

3 Big Social Security Changes Coming In 2026 May Surprise Retirees Social Security 2026 Cola Reveal Inflation Raise Want The Maximum Social Security Check In 2026 Here S What You Need ToWhen Will The 2026 Social Security COLA Be Announced Social Security Cola Information 1080x720 2026 Social Security COLA Forecast Revised Here S All You Need To 2026 Social Security COLA Forecast Revised Heres All You Need To Know 1024x683

Planning Can Maximize Your Social Security Benefits Sol Schwartz Web Image SS Chart 122x300 MAT Medication Assisted Treatment What It Is And How It Works Say Goodbye To Retiring At 65 Social Security Sets A New Retirement Age For 2026 Can You Work Full Time And Collect Social Security At Age 66 Image 215 Retirement At 65 Is Over Social Security Raises Full Retirement Age Social Security Sets New Retirement Age For 2026

OpenForge Government Embraces Open Source To Say Goodbye To Retiring At 65 Social Security Sets A New Retirement Age For 2026 1 Confirmed Social Security Raises Credit Threshold To 1 890 In 2026 Get Your 2026 Social Security Raise Early.webpCan You Retire In Rhode Island On Social Security Alone The 2026 872abd60 Cfd6 4e1e 90ff Social Security Payment Boost For 2026 Confirmed What To Expect From Social Securitys Full Retirement Age Is