Finding the best card processing solution is crucial for any business looking to accept electronic payments efficiently and affordably. As consumer habits shift further towards digital transactions, understanding the nuances of various processors becomes paramount. This guide explores key factors like transaction fees, hardware compatibility, customer support, and security measures, helping businesses in the United States navigate the complex landscape of payment processing. We aim to provide clear, actionable insights into selecting a provider that not only meets your operational needs but also supports your financial growth and customer satisfaction. Discovering the optimal best card processing partner ensures seamless operations and boosts profitability in todays competitive market.

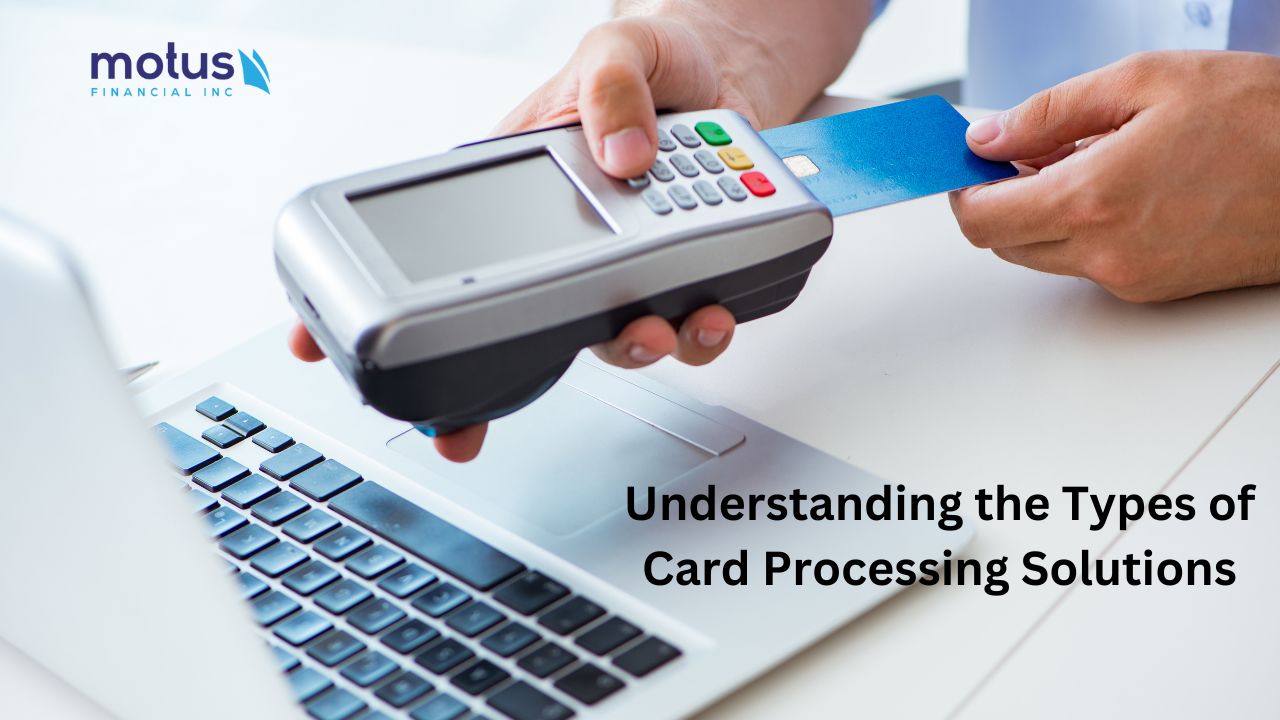

The best card processing solutions enable businesses across the United States to securely accept credit and debit card payments, a fundamental aspect of modern commerce. These services facilitate financial transactions from customers to merchants, typically involving a payment processor, a merchant account, and specialized hardware or software. Finding the optimal best card processing system involves evaluating costs, features, and support to ensure seamless operation and customer satisfaction in today's digital economy. H1 Navigating the Best Card Processing Landscape Understand that selecting the right best card processing provider is a significant decision for any business. It affects your financial health and how smoothly your daily operations run. This article will help you confidently choose a system that aligns perfectly with your business goals. H2 Understanding Your Needs for Best Card Processing Before diving into options, truly understand what your business needs from the best card processing service. Consider your sales volume, average transaction size, and where you'll be accepting payments. A small, mobile boutique will have vastly different requirements than a large e-commerce store or a busy restaurant. Knowing your specific operational flow helps narrow down the best card processing choices significantly. Think about the types of cards you need to accept, whether you require recurring billing features, and if international transactions are part of your plan. Do you need a physical terminal, a mobile reader, or an online payment gateway? These considerations are crucial for selecting a truly best card processing partner tailored to your unique business model. H2 Key Factors in Choosing Best Card Processing When searching for the best card processing, transparent pricing is perhaps the most critical factor. Look closely at interchange plus pricing, tiered pricing, and flat-rate models. Hidden fees, monthly minimums, and contract termination clauses can quickly erode your profits. Ensure you understand every line item before committing to any best card processing provider. Security and compliance are non-negotiable for the best card processing. Your chosen provider must be PCI DSS compliant to protect sensitive cardholder data. Strong encryption, fraud prevention tools, and tokenization services offer crucial layers of protection. A secure best card processing system safeguards both your business and your customers' trust. Integration with existing systems is vital for efficient best card processing. Check if the processor integrates smoothly with your point-of-sale (POS) system, accounting software, or e-commerce platform. Seamless integration minimizes manual entry errors and streamlines your overall business operations, making your chosen best card processing solution truly effective. Reliable customer support is essential, especially when dealing with the best card processing. Issues can arise at any time, from technical glitches to transaction discrepancies. Look for providers offering 24/7 support through various channels like phone, email, and live chat. Prompt and knowledgeable assistance can prevent costly downtime and frustration with your best card processing system. H2 Types of Best Card Processing Solutions H3 Traditional Merchant Accounts for Best Card Processing Traditional merchant accounts provide a dedicated relationship with a bank, offering robust features for businesses with high transaction volumes. While they often involve a more extensive application process, they can provide competitive rates for the best card processing. These accounts are usually best suited for established businesses seeking stability and tailored services. H3 Aggregators and Flat-Rate Best Card Processing Payment aggregators, like Square or Stripe, simplify the best card processing for small businesses and startups. They offer flat-rate pricing and quick setup, pooling many merchants under one large merchant account. This model provides immense convenience and flexibility, making it an excellent choice for businesses prioritizing ease of use for their best card processing. H3 Mobile Best Card Processing Mobile card processing allows businesses to accept payments anywhere using a smartphone or tablet with a card reader. This flexibility is perfect for food trucks, market vendors, or service professionals. The ease and portability of mobile best card processing ensure you never miss a sale, enhancing customer convenience significantly. H3 E-commerce Best Card Processing Gateways For online businesses, an e-commerce payment gateway is integral to the best card processing. This secure tunnel transmits card information from your website to the processor. Features like recurring billing, shopping cart integrations, and fraud detection are critical for a smooth and secure online purchasing experience, powered by effective best card processing. Best Card Processing Comparison Chart Feature | Flat-Rate Aggregators (e.g., Square) | Traditional Merchant Accounts (e.g., Helcim) | Online Payment Gateways (e.g., Stripe) Ideal For | Small businesses, startups, mobile sellers | Established businesses, high volume | E-commerce, recurring billing Pricing Model | Simple flat rate per transaction | Interchange plus or tiered | Flat rate or custom Setup Time | Fast, often same day | Longer, involves application | Fast, often same day Contract | No long-term contracts | Often includes long-term contracts | Flexible, no long-term contracts Customer Support | Varies, typically online/email | Dedicated account manager | Comprehensive online resources Hardware | Proprietary card readers | Diverse terminal options | API integrations, virtual terminals Fraud Tools | Basic to advanced | Robust, tailored | Advanced built-in tools H2 What Others Are Asking About Best Card Processing? H3 What is the most cost-effective card processing? The most cost-effective best card processing often depends on your specific business volume and transaction type. For smaller businesses, flat-rate options like Square or Stripe might be cheaper, while larger businesses could benefit from interchange-plus pricing from a traditional merchant account provider. Always compare total fees, not just per-transaction rates. H3 How do I choose a good payment processor for best card processing? To choose a good payment processor for best card processing, evaluate factors such as transparent pricing, contract terms, security features, customer support quality, and integration capabilities with your existing systems. Reading reviews and comparing multiple providers side-by-side will help you find the best fit for your unique business needs. H3 What percentage do card processing companies take for best card processing? Card processing companies for best card processing typically take a percentage ranging from 1.5% to 3.5% per transaction, plus a small flat fee (e.g., 0.10 to 0.30). This percentage varies based on card type, transaction method (in-person vs. online), and the specific pricing model offered by the processor. Always clarify all fees involved. H3 Are credit card processing fees negotiable for best card processing? Yes, credit card processing fees for best card processing are often negotiable, especially for businesses with high sales volumes. Merchants can leverage competitive offers from different processors to negotiate better rates, remove certain fees, or secure more favorable contract terms. It is always worth asking and comparing bids. H3 What is the cheapest way to process credit cards for best card processing? The cheapest way to process credit cards for best card processing often involves using an interchange-plus pricing model if you have significant volume, or a flat-rate aggregator for lower volumes. Additionally, encouraging customers to pay with debit cards or ACH transfers, which have lower fees, can also reduce overall processing costs for your business. H2 FAQ About Best Card Processing H3 Who benefits most from best card processing? Any business accepting customer payments, from small local shops to large online retailers, benefits from best card processing. It allows them to serve a broader customer base, increase sales, and operate efficiently in a cashless economy. H3 What is best card processing? Best card processing refers to the system and services that enable businesses to accept credit and debit card payments securely and efficiently. It involves a payment processor, merchant account, and necessary hardware or software to complete transactions. H3 Why is finding the best card processing important? Finding the best card processing is important because it directly impacts your business's profitability, operational efficiency, and customer satisfaction. The right solution minimizes costs, enhances security, and provides reliable service. H3 How does best card processing work? Best card processing works by capturing card data, encrypting it, and sending it to a payment gateway, then to the processor, and finally to the card networks and issuing bank for authorization. Once approved, funds are transferred to the merchant's account. Summary of Key Points Choosing the best card processing solution is a strategic decision for your business. Evaluate pricing transparency, robust security, seamless integration, and reliable customer support. Consider whether flat-rate aggregators, traditional merchant accounts, or specialized online gateways best fit your operational scale and transaction needs. Making an informed choice ensures efficient operations, boosts profitability, and maintains customer trust in the evolving digital payment landscape. Related blogs- Harmony Grove Rehab Your Path to Healing

- Grubhub Restaurant Login Guide Securing Your Business

- ShareFile Client Portal Secure Files Simplified

- Why Unlock Celular Is Your Next Smart Move for 2026?

- Harmony 44 Apartments Your Ideal Home Awaits

Choosing the best card processing involves understanding fees and contracts. Security and compliance are non-negotiable for best card processing. Customer support for best card processing is essential for smooth operations. Integration capabilities determine the flexibility of best card processing. Hardware and software options affect overall best card processing experience. Transparent pricing is key to finding the best card processing for your business.

Top Credit Card Processors For Small Businesses In 2024 By Jimmy 10 Best Credit Card Processing Companies Of 2024 Forbes Advisor Full Top Credit Card Processors In Canada Payment Processing Top Credit Card Processor Canada 1024x683

9 Best Instant Funding Credit Card Processing Get Paid In 2026 Card X Card3 Best Credit Card Processing Companies Of 2026 Business Org BORG Best Credit Card Processing For Small Businesses Top 2025 Topps Chrome Rookie Cards To Collect Top Travis Kelce Rookie Cards 2736 X 1423 Px 23 Scaled PPT Best Credit Card Processing Companies Of 2023 PowerPoint Best Credit Card Processing Companies Of 2023 L

Choose The Best Card Processing Motus Financial Choose The Best Card Processing Solutions Best HIPAA Compliant Credit Card Processors A Visual Guide To Credit Card Processing Fees Thumbnail 1024x1024 Credit Card Processing Companies Reviews Best Credit Card Processing Reviews 4 Best Credit Card Payment Processors In 2025 Ebce0482e6

7 Best Credit Card Processors For Salons Spas 2024 Best Credit Card Processor List Of Top Credit Card Processing Companies In 2024 By WebPays May Choose The Best Card Processing Motus Financial The Types Of Card Processing Solutions Printable 2026 Bingo Card Etsy Il Glkk

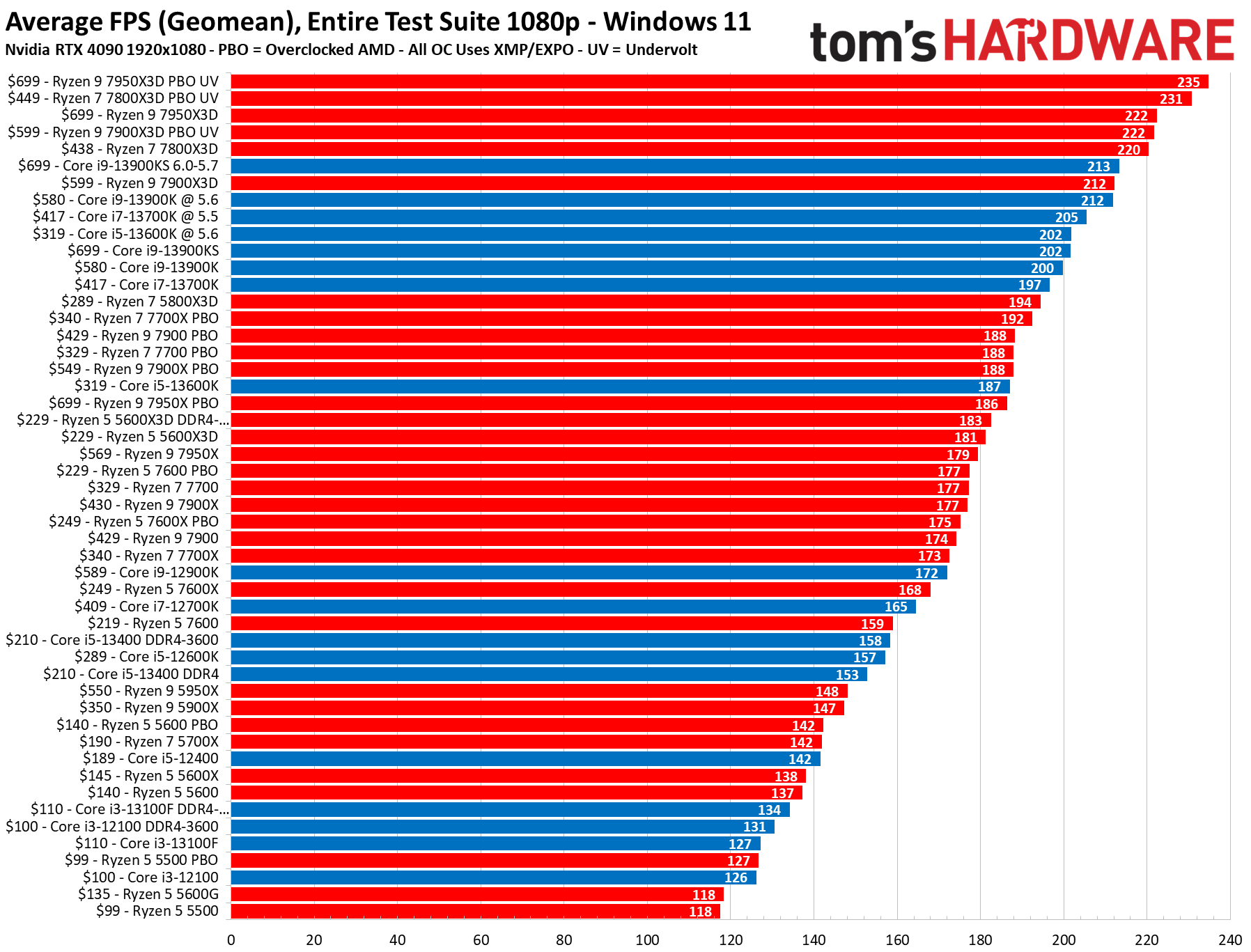

Top Credit Card Payment Processing In Canada For SMB Top 10 Credit Card Processors For Canada Swipesum Credit Card Processing Fees Average Transaction And Merchant Fees Credit Card Processing Scheme21@2x Best Budget Gaming CPU In 2026 Intel AMD Processors Graphics Cards Credit Card Processing A Definitive Guide M2P Fintech 1*K9bp4Kbg

Air Canada Priority Benefits On Aeroplan Credit Cards Explained Best Credit Cards In Canada Featured Image Best Credit Cards In India 2026 Cashback Rewards Guide Best Credit Cards India 2025.webpHappy New Year 2026 Greeting Card Design 3 D Golden Graphic 55855171 Happy New Year 2026 Greeting Card Design 3 D Golden Graphic Vector 9 Best Instant Funding Credit Card Processing Get Paid In 2026 LMS 1

Card Processing Motus Financial Best Card Processing System For Your Business Top Credit Card Payment Processing In Canada For SMB 7 Best Credit Card Processing Companies Unnamed 2024 07 2026 Happy New Year Greeting Card Template Design With Golden Number 2026 Happy New Year Greeting Card Template Design With Golden Number And Clock Vector

Best Credit Card Processing Companies Of 2026 REVEALED Best CC Processing Companies Blog HDD Benchmarks Hierarchy 2025 Here S All The Hard Disks We Ve Tested 8 BEST Credit Card Processing For QuickBooks In 2026 Stax 2 9 Best Virtual Terminals For Credit Card Processing In 2026 Best Cannabis Credit Card Processing 850x439

The Best Credit Card Processors Of 2025 Pricing And Hardware ImagePPT 5 Best Credit Card Processors For Merchants In 2024 PowerPoint 5 Best Credit Card Processors For Merchants In 2024 L Best Credit Card Processing Companies Of 2026 Business Org Paying With Credit Card 578x385 The 20 Best Credit Card Processing Software Ranked Reviewed For 2026 Web App Library Categories Providers Screenshots 003 362 527 Pub Square Screenshot 1727310161